How Facebook Taught Me to Adult and Saved Me Over $1500

Photo by rawpixel.com on Unsplash

When school prepares you for higher education more than everyday life what should be common knowledge becomes uncommonly known. I know I’m far from alone with my feelings on this. I’ve had enough conversations with friends and family members. One of the phrases that’s weighed heavily on me recently is “you don’t know what you don’t know.”

I had no idea how little I knew. Once I realized I needed to learn, where could I turn, though? Where could I learn about my financial options for healthcare, for dental care, for eye exams, for legal services, for taxes? In my frustration I turned to Facebook and found... that wasn't a bad idea. Here's how it's worked for me and why I think it could work for you, too.

Facebook Lesson #1: Healthcare

When I got the message from my old healthcare company that my membership with them would be expiring in a few months and I’d have to select a new one in the marketplace, I felt frozen. I didn’t even (and still only vaguely) understand the Affordable Care Act. I took my frustration to Facebook with a question, and got a flurry of responses.

Yes, 30 comments later I had a variety of options to look into and a few people I was able to talk to on the phone, too.

It made a huge difference. I chose my Cigna healthcare plan within those next 48 hours feeling much more confident than I was when I chose the one before. While I’m still pretty unhappy with the brokenness of the system, I found a place in it that works for me for now, and has reportedly saved me hundreds of dollars already.

Let’s just super conservatively say this has saved me $300, between savings in the cost of my monthly premiums and savings from doctors visits and medication I've been prescribed in the last few months.

Facebook Lesson #2: Legal + Tax Advice

As a newbie in the self-employment world, I knew there’d be learning curve. I knew I’d have some trial and error, and I’d need to be ready to make changes to make both my own and my clients’ experiences clearer and better.

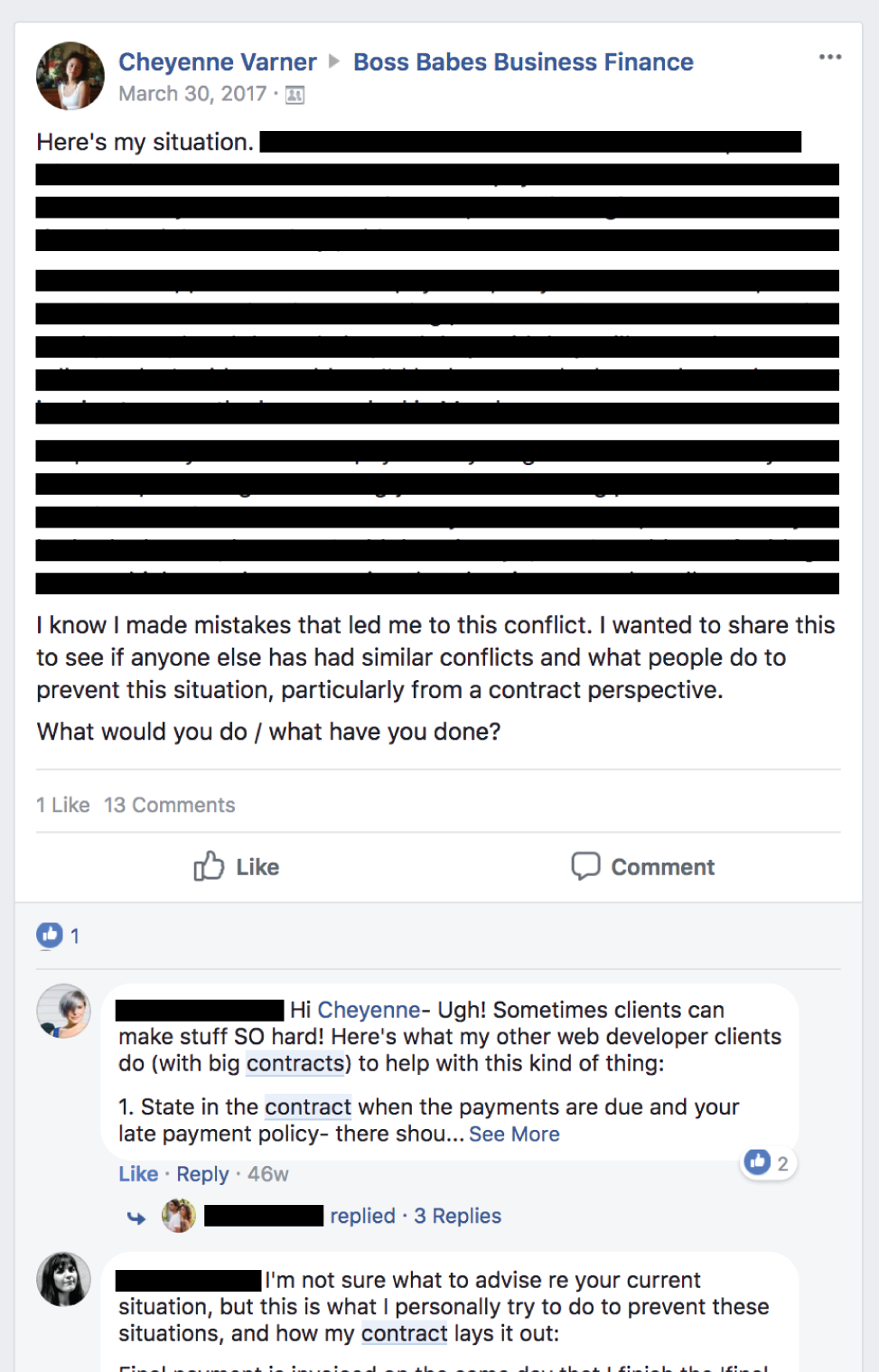

One huge example of this has been my contracts. When I had my first hiccups, I took my situation to a FB group I’d joined called Boss Babes Business Finance, and the responses were just what I needed. I cleaned my contract up and didn’t have the same problem again.

I’ve also asked a handful of questions about taxes in various FB spaces and gotten a ton of help. Including a connection to an amazing CPA I’m currently revamping my personal and business budgeting practices with.

I’ve saved hundreds of dollars by connecting to this professional through a small business mentorship group (let’s say $275 since that’s around the average cost of tax prep with a CPA), and I’ve saved hundreds of dollars by improving my contract (let’s say $400 since that’s the amount of money I lost from my early mistakes).

Extra Note: Research I’ve done off FB has also uncovered these two pretty amazing legal resources online — And.Co and Termly for anyone interested. Termly saved me hundreds of dollars, and a ton of time, by providing me what I needed to get my websites up to legal code in one evening — no need to hire someone for $150+ an hour (at least not yet).

Facebook Lesson #3: Dental Care

Because healthcare is ridiculously complicated, picking my health insurance was just the tip of the stress iceberg. I quickly realized I needed to go to the dentist and I had no idea where to go.

The first dental office I called quoted me around $350 for an appointment without dental insurance. And I didn’t have time to call up random places and compare. So I went to Facebook again. Like before, I got over 30 responses, and I started checking them out.

The VCU dental school seemed like the direction I was going to go in for a minute. I called and scheduled an evaluation. That would be $75 (just for the evaluation, the cleaning would be an additional cost if I was accepted in — and I’m guessing a pretty substantial one because they wouldn’t quote it over the phone). Still feeling a little uncertain, I checked another suggestion I’d been given: Groupon. And I am so glad. I found a $60 Groupon deal for an x-ray, exam, and cleaning just 20 minutes away at a dental office that scheduled me in even faster than the dental school.

Turns out that office has a specific plan for uninsured folks: $275 for two appointments (each including an x-ray, exam, and cleaning) a year. Considering one of those appointments averages around $250 in my area, I saved $190 with that one appointment, and I’ll save over $225 if I start that annual plan this summer for my next two.

Facebook Lesson #4: Vision Care

Just the other week I realized my glasses prescription has been expired for over 5 years. Womp. “Well,” I thought, “time to ask Facebook.”

About a dozen responses later I had a few places to check out. My previous eye place quoted me $80 for an exam to update my prescription with my vision insurance (which I was unable to get clear information about from my health insurance online account — still need to call them and ask them why that info’s not showing up). I set up an appointment since their waiting list was about a month long. Then I called Costco. Turned out they wouldn’t accept my vision insurance. I asked how much the exam would cost without it. Around $60. Alright, though. That was still better than the other place and they didn’t have much of a waiting list. I planned to cancel that other appointment and schedule with Costco on Monday.

Then, plot twist. FB notified me about another response: a friend suggested I check out America’s Best Contacts and Eyeglasses. So I did. And would you look at that, $45 eye exams without insurance, and I could potentially get two pairs of glasses as well for around $70-$100 total.

I’m saving $35 at minimum, and potentially a lot more considering the last time I got new frames I paid $100 for one pair alone (let’s say I’m saving $180 since two pairs of glasses and an eye exam with the last places I purchased those from would have cost me around $280 and I'll probably get glasses, too).

Totaling Up My Facebook Education Savings

Alright so let’s review. I took the following financial issues to Facebook and saved how much?

Healthcare (Primary & OBGYN): $300

Legal + Tax Advice: $275 + $400

Dental Care: $190 + $225

Eye Care: $180

Total: $1570

Now that's a number I can get behind (!!), especially since it cost me $0 to get the information that led me to the savings. While I learned none of this in high school or college, I did learn about economic theories back then. Now, if I recall the lingo correctly, this whole situation is basically how you can use social/human capital to save financial capital. Am I right? Did I get it? Either way... Class dismissed!

... Pssst. One thing. Do you have savings stories like this, or other thoughts, or questions? Share in the comments below.